pay mississippi state taxes by phone

General Information phone 601 923. This automated service is available 24 hours 7 days a week.

Mississippi State Income Tax Ms Tax Calculator Community Tax

General Information phone 601 923-7700 Tax Refund Information For information on your tax refund 24 hour refund assistance is available touchtone phones only.

. Pay directly from a checking or savings account for free. How do you calculate state taxes in Mississippi. Taxpayers must pay personal income tax to the federal government 43 states and many local.

Credit or debit cards. John is filing as a single taxpayer in Mississippi. Ssn tax year form type filing status.

You can use this service to quickly and securely pay your Mississippi taxes using a. Pay your taxes by debit or credit card online by phone or with a mobile device. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

The state uses a simple formula to determine how much someone owes. Mississippis income tax ranges between 3 and 5. Lets take a look at an example provided by the Mississippi Department of Revenue.

Failure to file the required return will subject you to the penalty provisions under the Mississippi Tax Laws. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. Cre dit Card or E-Check Payments.

At the end of your call you will be given a. The tax rates are as follows. Stay updated with taxes wage hour and labor laws for the state of Mississippi at SurePayroll.

Pay your taxes by phone by calling Official Payments toll-free at 1-800-272-9829. The median property tax in Mississippi is 50800 per year052 of a propertys assesed fair market value as property tax per year. Mississippi has one of the lowest median property tax.

His annual taxable income is 23000. Mississippi payroll taxes can be hard to understand pay file. Mississippi Tax QuickPay Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

Get your Mississippi State. 0 on the first 2000 of taxable income. 313 rows An American household with four wireless phones paying 100 per month for wireless voice service can expect to pay about 270 per year in wireless taxes fees.

Pay Mississippi State Taxes By Phone phone state taxes Edit. Jefferson city 35 and kansas city 4875 local business license tax. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

You will need your. There is an additional convenience fee to pay through the msgov portal. Pay by credit card or e-check.

How to Make a Credit Card Payment. Mississippi also has a 400 to 500 percent corporate income tax rate. The 2020 Mississippi State Income Tax Return forms for Tax Year 2020 Jan.

Detailed Mississippi state income tax rates and brackets are available on.

Mississippi Tax Rate H R Block

These States Don T Tax Military Retirement Pay

Home Page Mississippi Federal Credit Union

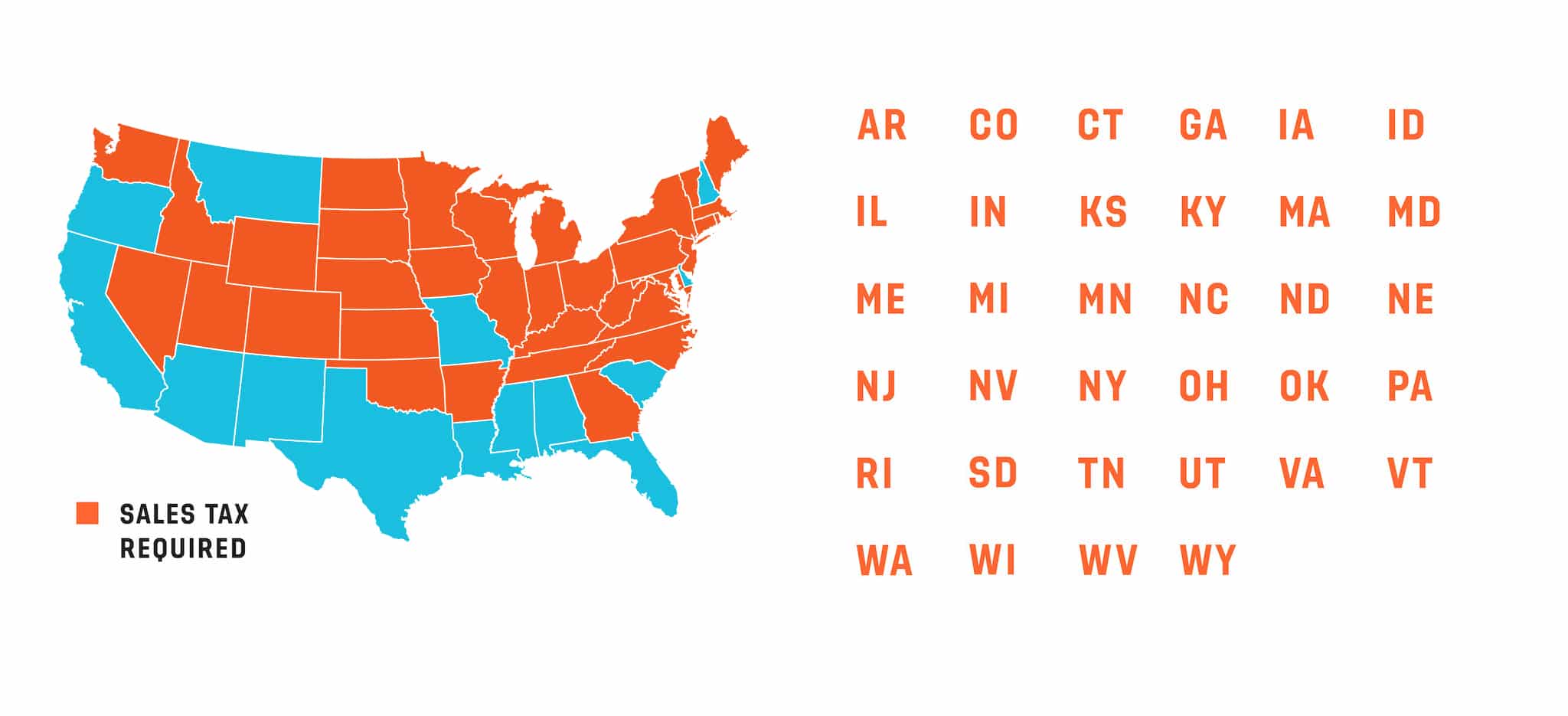

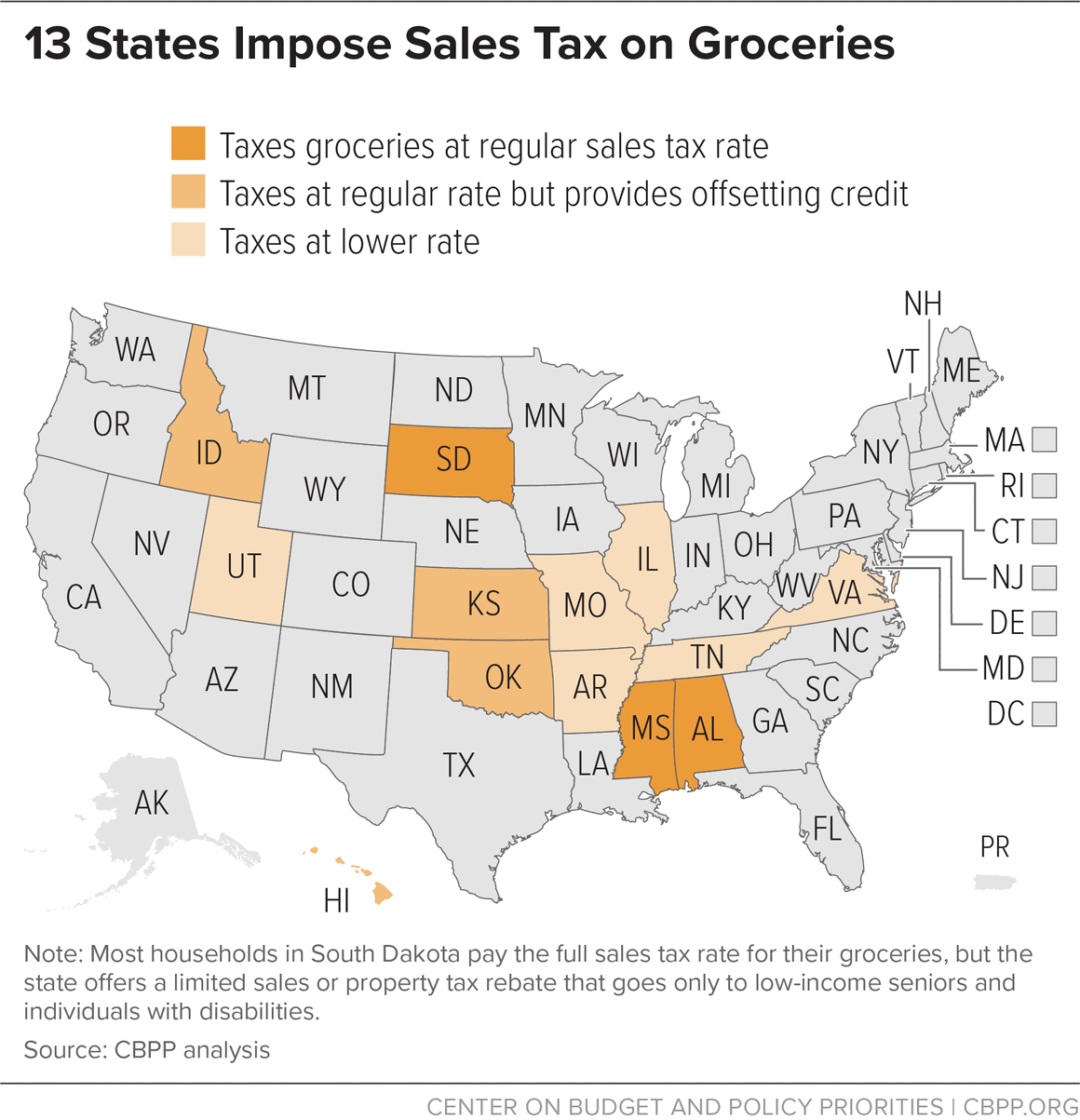

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Commentary Mississippi Should Invest In Its People Not Chase The False Promise Of Tax Competitiveness Center On Budget And Policy Priorities

Prepare Your 2021 2022 Mississippi State Taxes Online Now

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Where S My State Tax Refund Updated For 2022 Smartasset

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Mississippi Retirement Tax Friendliness Smartasset

Mississippi Income Tax Cut Grocery Tax Reduction

State Corporate Income Tax Rates And Brackets Tax Foundation

Mississippi County Property Tax A Secure Online Service Of Arkansas Gov